UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant S

Filed by a Party other than the Registrant £

| | | | | |

| Check the appropriate box: |

| £ | Preliminary Proxy Statement |

| £ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | Definitive Proxy Statement |

| £ | Definitive Additional Materials |

| £ | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | |

|

| MVB Financial Corp. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check all boxes that apply): |

| | |

| S | | No fee required. |

| | |

| £ | | Fee paid previously with preliminary materials. |

Notice of 2022 Annual Meeting of Shareholders and Proxy Statement

301 Virginia Avenue

Fairmont, WV 26554

| | | | | | | | | | | |

| Notice of 20222024 Annual Meeting of Shareholders | |

| via Live Webcast, please visit: | May 17, 202221, 2024 | |

| www.meetnow.global/M649UNM | | 9:10:00 a.m. EDT | |

| | | |

| The Notice of Meeting, Proxy Statement, and Annual Report on Form 10-K

are available free of charge at ir.mvbbanking.com.

| |

To the Shareholders:

The 20222024 Annual Meeting of Shareholders (the “Annual Meeting”) of MVB Financial Corp. (“MVB”, the “Company”, “we” or the “Company”“our”) will be held via live webcast this year at 9:10:00 a.m. EDT on May 17, 2022. As we continue to monitor the status of the COVID-19 (coronavirus) pandemic, we have elected to conduct this year's Annual Meeting virtually once again, which means that you21, 2024. You will be able to participate, in substantially the same manner as if you were attending the meeting in person, including the ability to submit questions and vote your shares electronically during the meeting via live webcast by visiting www.meetnow.global/MCFYCRU.M649UNM. You will not be able to attend the Annual Meeting in person. The Proxy Statement contains additional information regarding registering for and attending the annualAnnual Meeting. The webcast will begin promptly at 9:10:00 a.m. EDT and online access will be available beginning at 8:9:00 a.m. EDT. We encourage you to access the webcast prior to the start time. Although very unlikely, please be aware of the possibility that the date, time, or location of the Annual Meeting may change due to the COVID-19 pandemic based on MVB's facts and circumstances. ThisThe purpose of this meeting is for the purposes of consideringto consider and voting uponvote on the following proposals:

MVB Financial Corp. 2022 Proxy Statement

| | | | | |

| Items of Business |

| 1 | To elect the three director nominees named in the Proxy Statement. |

| |

| 2 | To approve on a non-binding, advisory basis, the compensation of our named executive officers. |

| |

| 3 | To ratify the appointment of Dixon Hughes GoodmanFORVIS, LLP as the independent registered public accounting firm for 2022.2024. |

| |

| 4 | To approve the MVB Financial Corp. 2022 Stock Incentive Plan. |

| |

5 | To transact such other business as may properly come before the Annual Meeting and any postponements or adjournments thereof. |

| |

| Record Date |

Only MVB Financial Corp. shareholders of record at the close of business on March 28, 202227, 2024 (the “Record Date”) shall be entitled to vote at the Annual Meeting and any adjournments or postponements of the meeting. A list of shareholders entitled to vote at the Annual Meeting is available for inspection at our principal executive office at 301 Virginia Avenue, Fairmont, WV 26554. The notice of Annual Meeting, Proxy Statement, proxy card, and other proxy materials are first being sent or made available to shareholders on or about April 7, 2022.8, 2024. As of the Record Date, there were approximately 12,141,32412,840,883 shares of the Company’s Voting Common Stockvoting common stock outstanding. |

MVB Financial Corp. 2024 Proxy Statement

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held Virtually on May 17, 2022.21, 2024.

We have elected to take advantage of Securities and Exchange Commission (“SEC”) rules that allow us to furnish proxy materials to certain shareholders on the Internet. Instead of receiving paper copies of our proxy materials in the mail, shareholders will receive a Notice of Internet Availability of Proxy Materials (“Notice”) which provides an internet website address where shareholders can access electronic copies of proxy materials and vote. This website also has instructions for voting by telephone and for requesting paper copies of the proxy materials and proxy card. The Company's 20222024 Proxy Statement, proxy card and Annual Report for fiscal year 20212023 are available online at www.investorvote.com/MVBF. We encourage you to access and review such materials before voting.

Your vote is very important to us. Whether or not you expect to attend the Annual Meeting via webcast, we urge you to consider the Proxy Statement carefully and to promptly vote your shares.

Sincerely,

Chief Executive Officer

April 7, 20228, 2024

(approximate mailing date)

Your vote is important. Please vote.

Table of Contents

| | | | | |

| Proxy Statement Summary | 4 |

| MVB Values and Culture | |

| Corporate Governance | |

| Role of the Board of Directors | |

| Board Committees | |

| Board Leadership Structure | 12 |

| Annual Board and Committee Assessment | |

| Audit Committee Financial Experts | 17 |

| Code of Ethics | |

| Transactions with Related Persons | |

| Attendance of Directors at Annual Meeting of Shareholders | |

| Communications with the Board | |

| Directors | |

| Director Overview | |

| Nominees for Election | |

| Directors Not Up For Election | 24 |

| Compensation of Directors | |

| Executive Officers | |

| Executive Compensation | 32 |

| Human Resources and Compensation Committee Report | 32 |

| Compensation Discussion and Analysis | 33 |

| Executive Compensation Tables | 54 |

| Summary Compensation Table | 54 |

| Grants of Plan-Based Awards | 56 |

| Outstanding Equity Awards | 57 |

| Option Exercises and Stock Vesting | 57 |

Potential Payments Upon Termination or Change ofin Control | 58 |

| Retirement Plans | 5260 |

| CEO Pay Ratio | 61 |

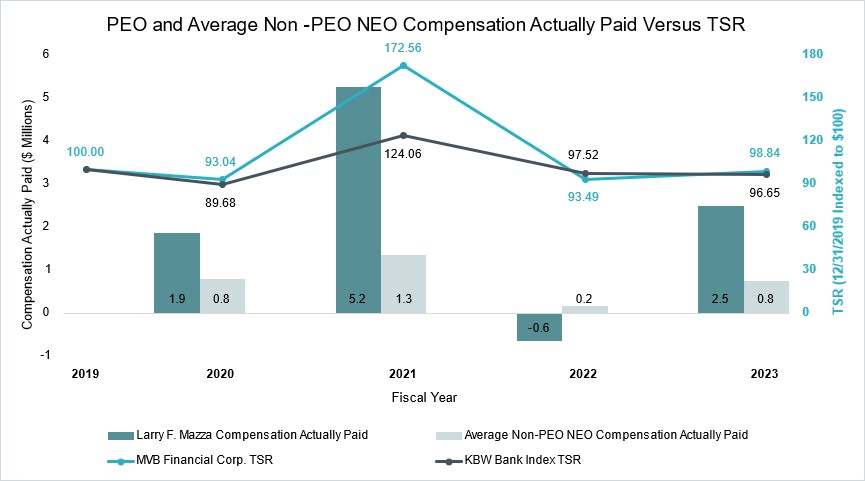

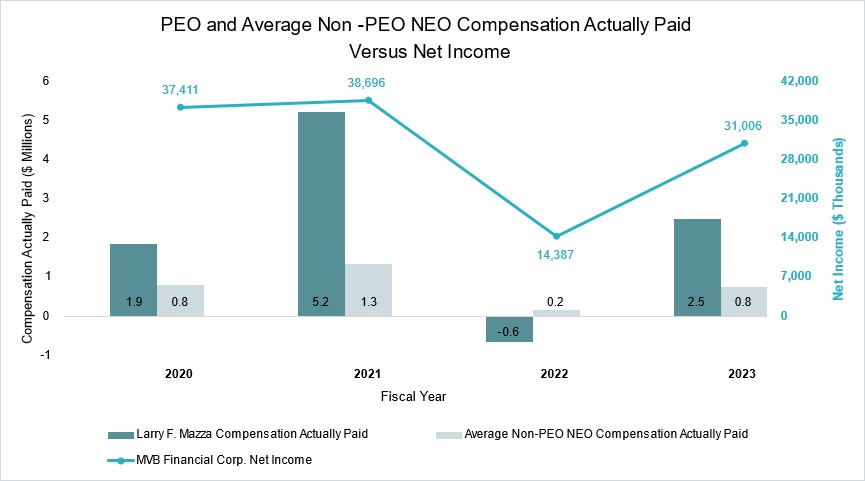

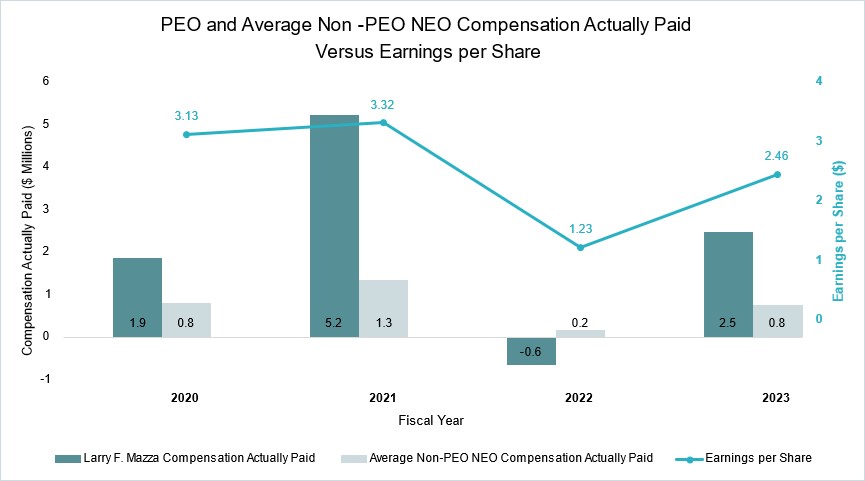

| Pay Versus Performance | 62 |

| Environmental, Social, & Governance (ESG) | 68 |

| Proposals | 69 |

| Proposal No. 1 – Election of Directors | 6169 |

| Proposal No. 2 – Advisory Vote to Approve Executive Compensation | 6270 |

| Proposal No. 3 – Ratification of Appointment of Independent Registered Public Accounting Firm | 70 |

Proposal No. 4 – Approval of MVB Financial Corp. 2022 Stock Incentive PlanOther Information | 6372 |

Other Information | |

| Audit Committee Report | 72 |

| Security Ownership of Certain Beneficial Owners and Management | 72 |

| General Information | 74 |

| Appendix |

MVB Financial Corp. 2022 Stock Incentive Plan | A-1 |

MVB Financial Corp. 20222024 Proxy Statement

Proxy Statement Summary

This

MVB Financial Corp. (“MVB” the “Company”, “we” or “our”) is furnishing this Proxy Statement in connection with the solicitation by our Board of Directors (our “Board”) of proxies to vote at the 20222024 Annual Meeting of Shareholders (the “Annual Meeting”) of MVB. The following summary provides an overview of the Annual Meeting, the proposals that will be acted on, how to vote your shares, and information about our corporate governance and executive compensation program. We encourage you to carefully review all of the important information contained in this Proxy Statement carefully before voting.

20222024 Annual Meeting of Shareholders

via Live Webcast May 17, 202221, 2024

9:at www.meetnow.global/M648UNM) 10:00 a.m. EDT

The record date for the Annual Meeting is March 28, 202227, 2024 (the “Record Date”). Only shareholders of record as of the close of business on this date are entitled to vote at the Annual Meeting.

The Annual Meeting will be held via live webcast this year at 9:10:00 a.m. EDT on May 17, 2022. As we continue to monitor the status of the COVID-19 (coronavirus) pandemic, we have elected to conduct this year's Annual Meeting virtually once again, which means that you21, 2024. You will be able to participate, in substantially the same manner as if you were attending the meeting in person, including the ability to submit questions and vote your shares electronically during the meeting via live webcast by visiting www.meetnow.global/MCFYCRY. M649UNM. You will not be able to attend the Annual Meeting in person. Although very unlikely, please be aware of the possibility that the date, time, or location of the Annual Meeting may change due to the COVID-19 pandemic based on MVB's facts and circumstances.

Items of Business and Voting Recommendations

| | Proposal | Recommendation of the Board | Page |

| Proposal | | | Proposal | Recommendation of the Board | Page |

| 1 | 1 | To elect to the Board of Directors the three nominees presented by the Board to serve a three-year term. | FOR ALL of the nominees | 61 | 1 | To elect to the Board of Directors the three nominees presented by the Board. | FOR ALL of the nominees | 69 |

| 2 | 2 | To approve on a non-binding advisory basis, the compensation of our named executive officers. | FOR | | 2 | To approve on a non-binding advisory basis, the compensation of our named executive officers. | FOR | 70 |

| 3 | 3 | To ratify the appointment of Dixon Hughes Goodman LLP as the independent registered public accounting firm for 2022. | FOR | | 3 | To ratify the appointment of FORVIS as the independent registered public accounting firm for 2024. | FOR | 70 |

| 4 | To approve the MVB Financial Corp. 2022 Stock Incentive Plan. | FOR | 63 |

How to Vote

To vote online, visit www.investorvote.com/MVBF and enter the control number found in your Notice of Internet Availability of Proxy Materials. You may also vote prior to the Annual Meeting by mail or by phone. For more detailed information, see Voting Procedures beginning on page 75.76.

Your vote is important. Please vote.

Corporate Governance Highlights

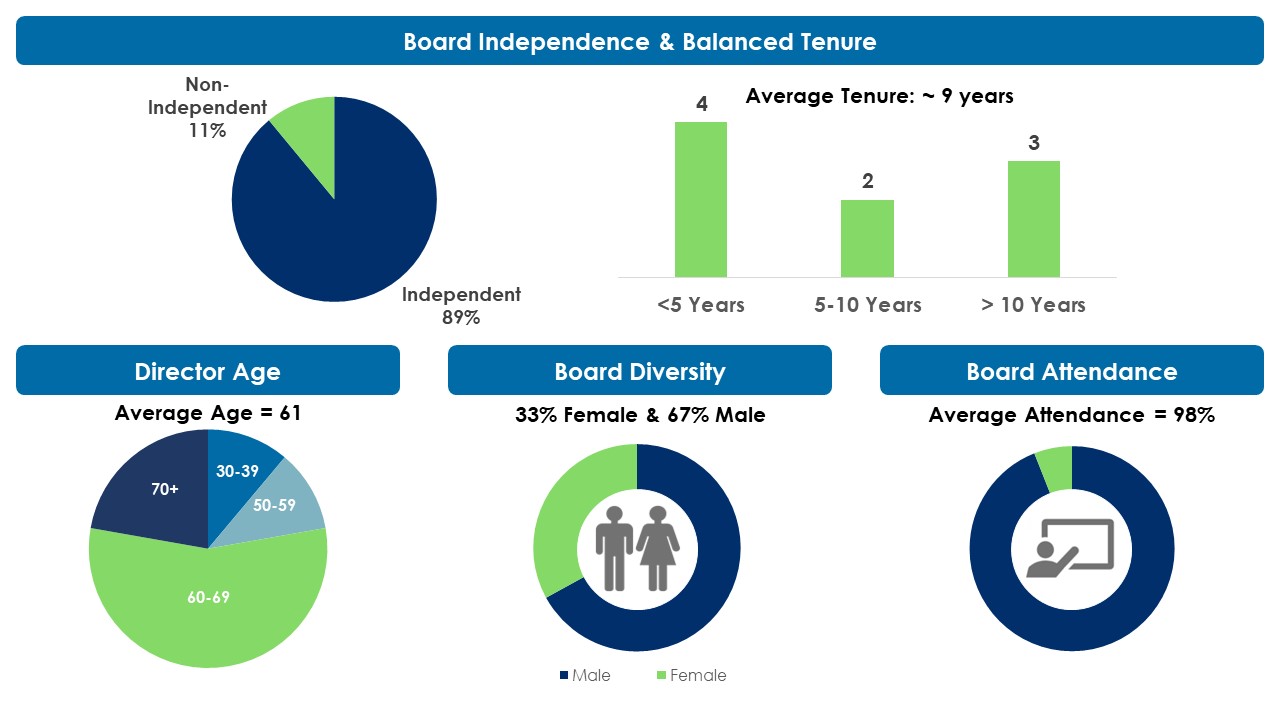

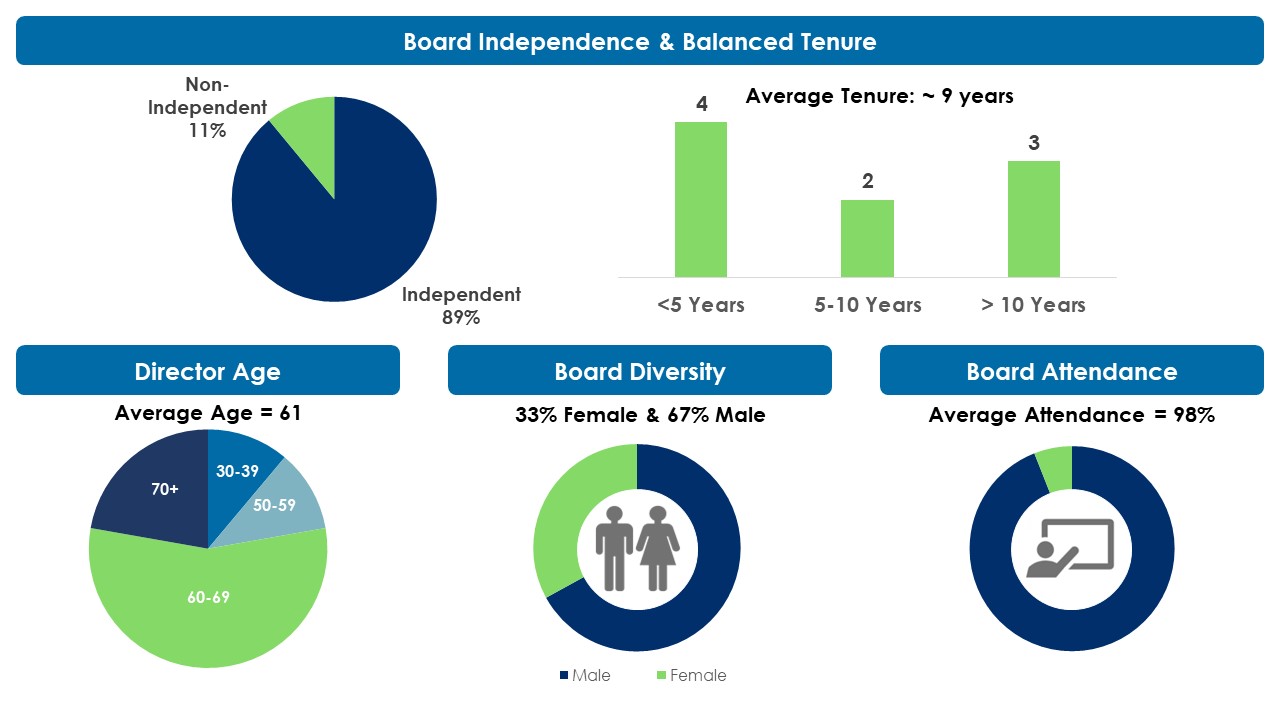

Our corporate governance structure fosters principled actions, informed and effective decision-making, and appropriate monitoring of compliance and performance.performance monitoring. On August 6, 2021, the U.S. Securities and Exchange Commission (the “SEC���“SEC”) approved a Nasdaq Stock Market (“Nasdaq”) rule change requiring its listed companies to have, or explain why they do not have, at least two diverse directors. This new rule requires all companies listed on Nasdaq’s U.S. exchange to publicly disclose consistent, transparent diversity statistics regarding their board of directors. We are in full compliance with this new rule and no changes were necessary to become compliant. In addition, board refreshment is taking on greater significance. A few governance highlights are as follows:

–Eight of our nine Directors are independent

–Separate Chairman, CEO, and President roles

–Three of our nine Directors are diverse (two females and one self-identified Hispanic/Latino)(three females)

–Three Directors have prior public board experience

–The Board as a whole has a wide range of expertise

–Balanced Director tenure with an average tenure of approximately seveneight years

–Board composition is diverse in age, skills, and experiences

–Independent Directors regularly meet without management present

–Annual Board review and self-evaluation

–Active shareholder engagement and communication

–Stock ownership requirements for Directors and executive officers

–Board responsibility for risk oversight

–Independent compensation consultant engaged

Board of Directors and Committees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MVB Financial Corp. | MVB Bank, Inc. | Independent |

| Audit | Finance | N&CG | Compensation | Risk | ALCO | Loan Approval | Loan Review |

David B. Alvarez

Chairman

| | | | | | | X | | X |

| W. Marston Becker,Chairman | | X | | XChair | | X | | | | | X |

| John W. Ebert | X | ChairX | Chair | X | | | | | X |

| Daniel W. Holt | | | X | | | X | | | | | | X |

| Gary A. LeDonne | X | XChair | | | X | Chair | | X | | X | X |

Larry F. Mazza CEO | | | | | | | XX | X | |

| Kelly R. Nelson, MD | | | X | | Chair | X | | Chair | | X | | X |

J. Christopher PallottaJan Lynn Owen | | | X | | X | | | | Chair | Chair | Chair | X |

Anna J. SainsburyLindsay A. Slader | | | | X | X | X | | X | | | | X |

| Cheryl D. Spielman | Chair | X | | | X | | X | | | | X |

The committee membership above reflects the membership for fiscal year 20212023 and during the period leading up to the Annual Meeting. Please see the changes that will occur following the Annual Meeting in the respective committee descriptions, beginning on page 10. For a detailed discussion of our corporate governance and directors, please see the section entitled “Corporate Governance” and the section entitled “Directors.”

MVB Financial Corp. 20222024 Proxy Statement

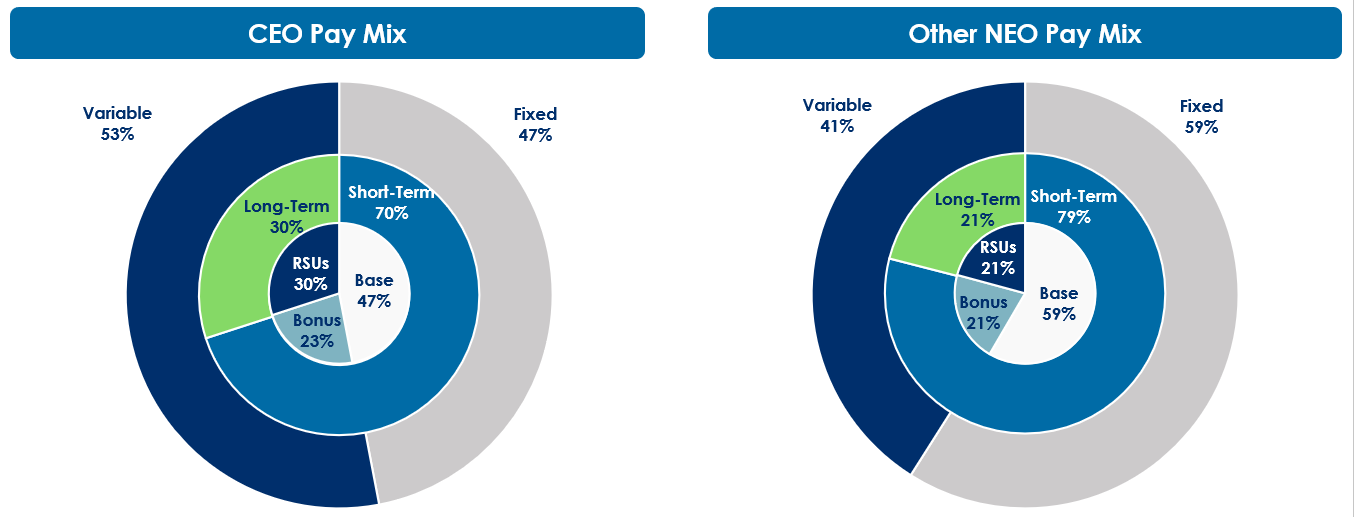

Executive Compensation Program Highlights

Our executive compensation program is designed to motivate and reward exceptional performance in a straightforward and effective way, while also recognizing the size, scope, and success of MVB’s business.

Consistent and EffectiveSound Program Design

We follow clear guiding principles in the design of the compensation program for our named executive officers and are committed to sound compensation policies and practices. We achieve our objectives through compensation that we believe does not encourage unnecessary and excessive risk taking. The overall design of our compensation program and each of its three primary components listed below have remained consistent year-over-year.

•Annual Base Salary

Fixed element of annual compensation

•Short-Term Incentives

Short-term cash incentive with variable payout opportunities based on operating results measured against annual performance goals

•Long-Term Incentives

Long-term equity incentives in the form of time-based and performance-based restricted stock units (“RSUs”) with multi-year vesting schedules

Aligned with Shareholder Interests and Company Performance

•Short-term incentive opportunities are capped and have challenging performance goals tied to key measures of overall companyCompany performance.

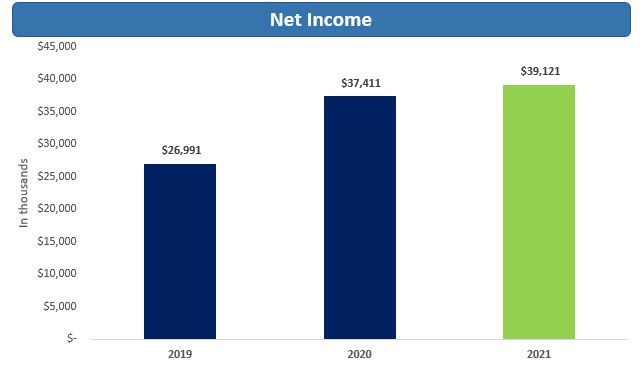

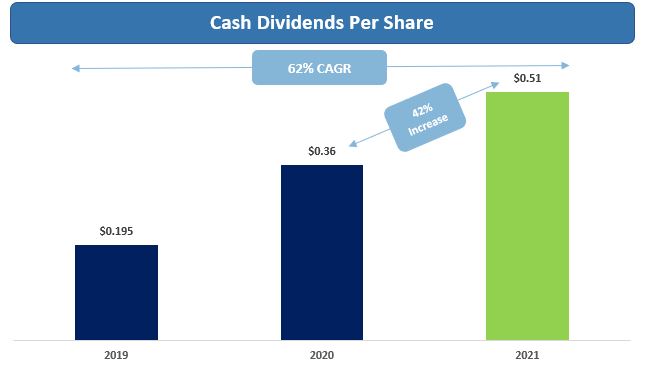

•Short-term incentives paid out at 190% of target for 2021. FourAchieved meeting the primary Earnings per Share (“EPS”) trigger and above maximum performance on three of the five benchmarks were achieved at the maximum payout. The Net Interest Margin (“NIM”) metric was adjusted because 2021 Non Interest Bearing (“NIB”) deposit growth significantly exceeded expectations and drove a lower margin than budget.

•Performance-based RSUs vest based on MVB’s total shareholder return and return on assets relative to peer companies over a three-year performance period.

•In 2021, 2019 performance-based RSUs vested at the maximum performance based on MVB’s performance relative to peer companies. Over the 3-year period, MVB’s average Return on Assets was 1.57% which was above the maximum performance levelfour financial scorecard metrics resulting in a 2023 plan payout of 150%at 107.99% of target. MVB’s Total Shareholder Return

•Revised the long-term incentive plan to add a relative TSR modifier to measure all results between the 25th and 75th percentiles of 139.49% ranked at the 100th percentile resulting in a payout of 150% of targeted vested shares.peers.

•Shareholders have an annual opportunity to cast an advisory vote on the compensation of our named executive officers and have indicated strong support in the past for our executive compensation program.program in the past.

•98.90%91.53% of votes cast on the say-on-pay proposal at the 20212023 Annual Meeting were voted in favor of the compensation paid to our named executive officers.

For a detailed discussion of our executive compensation program, please see the section entitled “Compensation Discussion and Analysis.”

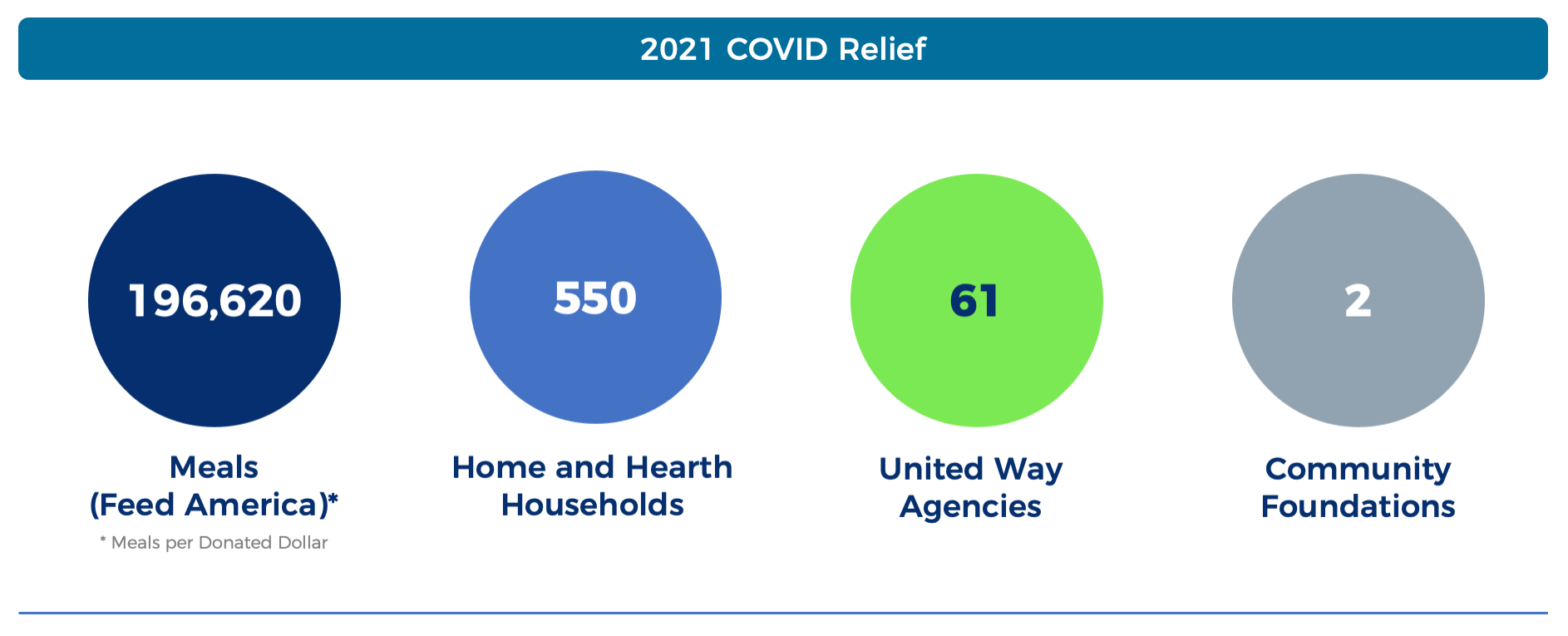

Environmental, Social, and Governance (ESG) Highlights

Our Board has oversight responsibility for environmental, social, and governance (“ESG”) and sustainability-related activities and receives reportingregular reports from management on these items. Management supports these activities and provides strategic guidance and senior-level review on ESG. For a detailed discussion of our ESG programs, please see the section entitled “ESG and Sustainability-Related Activities” on page 53.activities.

MVB Values and Culture

MVB’s “Purpose” is to be “Trusted Partners on the Financial Frontier, Committed to Your Success.” We talk a lot aboutuphold our core values of Love, Trust, Commitment, being AdaptiveAdaptability, and showing Teamwork. This section describes the values of MVB that guide our team members in making their most important day-to-day decisions.

Values

| | | | | |

| Trust

We are reliable and act with integrity. We can be counted on and count on others.

|

| |

| Commitment

We take ownership of our responsibilities in support of MVB achieving its Purpose. |

| |

| Respect, Love, and Caring

We are respectful, considerate, and thoughtful towards our team members, clients, and community. |

| |

| Teamwork

We effectively and efficiently work with others to accomplish more. |

| |

| Adaptive

We easily respond to change in a productive way. |

Strong Culture

At MVB, we remain committed to maintaining and growing our culture by leveraging our purpose, values, and associated behaviors. We have successfully operationalized our Culture Initiative by embedding these elements into our daily life. Examples of this can be found in our talent acquisition, onboarding, education, and performance processes. We take time to listen to our team members, to understand areas of opportunity, and to provide support that enables us to execute on our business strategy. That approach has helped us build something special and differentiate us from others.

MVB Financial Corp. 20222024 Proxy Statement

Corporate Governance

This section describes MVB’s corporate governance framework and the role and structure of our Board.

Role of the Board of Directors

MVB’s Board oversees the Chief Executive Officer (“CEO”) and other senior management in the operation of MVB and assures that the long-term interests of shareholders are being served. To satisfy the Board’s duties, directors are expected to take a proactive, focused approach to their positions to ensure that MVB is committed to business success through the maintenance of high standards of responsibility and ethics.

The Board believes that MVB’s governance structure fosters principled actions, informed and effective decision making, and appropriate monitoring of compliance and performance.performance monitoring. MVB’s key governance documents are available at ir.mvbbanking.com/govdocs.

In the opinion of theThe Board has determined that, none of the directors, except for Larry F. Mazza, MVB’s CEO, has a relationship with MVB that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. None of them areNo director is or havehas for the past three years been team members of MVB, except for Mr. Mazza, and none of their immediate family members are or have for the past three years been executive officers of MVB or MVB’s wholly-ownedwholly owned subsidiary, MVB Bank, Inc. (“MVB Bank”). InBased upon its review, the opinion of MVB and its Board the entire Board,has determined that each director, except for Mr. Mazza, are “independent directors,”is “independent” as that term is defined in Rule 5605(a)(2) of the Nasdaq Marketplace Rules.

The Board of Directors of MVB had nine (9)eight (8) regularly scheduled meetings and three (3)six (6) additional special project and strategic initiative meetings during 2021.2023. On a regular basis, Director Mazza and members of the executive management team are excused from the meetings so the Board can hold an executive session to discuss matters privately. The Chair relays any action items to the CEO if necessary. All current directors except for one, attended 75% or more of the meetings held by the Board and committees thereof in which the director is a member, with an average total attendance record of 95%. Director Sainsbury attended 65%98%.

All subsidiaries of MVB operate under the MVB holding company. As part of the governance structure, all MVB subsidiary boards have representation from the Board, which increases awareness of the day to dayday- to-day operations of the subsidiaries.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Directors on Subsidiary Boards | Independent |

| Proco Global | Potomac Mortgage Group | MVB Insurance | MVB CDC | Paladin Fraud | Chartwell Compliance | MVB Edge Ventures | Trabian | FlexiaMVB Technology | Victor |

David B. Alvarez | X | Chair | X | | | | | | | X |

| W. Marston Becker | | | Chair | | X | | | | X | | | | X |

| John W. Ebert | | | | | | | | | X | | | | | | | X |

| Daniel W. Holt | | | | X | X | X | | | X | | | | X |

| Gary A. LeDonne | | Chair | | | | X | | Chair | | | X | | | X |

Larry F. Mazza CEO | XChair | X | X | X | XChair | ChairX | X | X | | X |

| Kelly R. Nelson, MD | X | | | X | | | | | X | X | | | | | X |

J. Christopher PallottaJan L. Owen | | | | X | | | | | X | X | | | | | X |

Anna J. SainsburyLindsay A. Slader | X | | | | | | | | X | | | | X |

| Cheryl D. Spielman | X | | | | | | | | X | | X | | | X |

Board Committees

The Board has a standing Audit Committee, Finance Committee, HRHuman Resources and Compensation Committee (the “Compensation Committee”), Nominating and Corporate Governance Committee (the “N&CG”), and Risk and Compliance Committee. Also, at the MVB Bank level are the following committees: Asset & Liability Committee (“ALCO”), Loan Approval Committee and the Loan Review Committee.

The Board has determined that the Chair of each committee and all committee members are independent under applicable Nasdaq and SEC rules for committee memberships. Each committee operates under a written charter adopted by the Board. Charters for the Audit Committee, Finance Committee, N&CG Committee, Compensation Committee, and Risk and Compliance Committee are available at ir.mvbbanking.com/govdocs.governance/governance-documents/default.asp.

Audit Committee

The purpose of the Audit Committee is to:

1.assist the Board in monitoring the integrity of the financial reporting process, systems of internal controls and financial statements and reports of MVB;

2.be directly responsible for the appointment, compensation and oversight of the independent auditor engaged by MVB for the purpose of preparing or issuing an audit report or related work;

3.be responsible for the appointment, compensation and oversight of the internal auditor;

4.assist the Board in monitoring compliance by MVB with legal and regulatory requirements, including holding company, banking, mortgage and insurance regulations and the Sarbanes-Oxley Act of 2002;

5.oversee management corrective actions when such needs have been identified; and

6.oversee MVB’s whistleblower policy.

MVB Financial Corp. 2022 Proxy Statement

The Audit Committee meets with MVB's Chief Audit Executive, who oversees the internal audit function of MVB, and Dixon Hughes Goodman LLP,FORVIS, who is responsible for the annual certified audit, as well as with the members of the regulatory authorities upon completion of their annual financial statement audit and internal controls over financial reporting audit of MVB Bank or MVB. The Chief Audit Executive engages Crowe, LLP to conduct outsourced audits of Information Technology and other selected audit areas requiring specialized expertise. During these meetings, members of the management of MVB Bank or MVB, including Mr. Mazza and Donald T. Robinson, President and Chief Financial Officer of MVB, may be asked to leave the room to provide comfort ofto questioners and responders.

The Audit Committee Charter was reviewed and approved by the Board on August 25, 2021.October 9, 2023. The Audit Committee met ten (10)sixteen (16) times in 2021.2023. Messrs. Ebert, LeDonne, and Pallotta and Ms. Spielman served on the Audit Committee for fiscal year 20212023 and during the period leading up to the Annual Meeting, with Ms Spielman serving as the Chairperson. The same committee membership, excluding Mr. Pallotta, who will be retiring effective as of the date of the Annual Meeting, will continue with Ms. Spielman continuingwill continue to serve as Chairperson, but Dr. Nelson will replace Mr. Ebert on the Audit Committee following the Annual Meeting.

Finance Committee

The purpose of the Finance Committee is to:

1.provide oversight and guidance regarding finance, capital, budget, mergers and acquisitions, new lines of business, and facilities matters and to make recommendations, as appropriate and warranted; and

2.review and provide recommendations for fintech investments

The Finance Committee reviews MVB’s overall financial plan, balance sheet, and capital structure, andstructure. The Finance Committee also monitors the financial performance of the organization and its subsidiaries and business lines against approved budgets, long-term trends and industry benchmarks. The Finance Committee reports the results from these meetings to the Board. The Finance Committee also assists the Board in its review ofreviewing the Company’s annual operational budget and annual capital budget.budgets. Lastly, the Finance Committee is tasked with oversight ofoversees the Company’s equity and other investments in fintech companies.

The Finance Committee Charter wasMVB Financial Corp. 2024 Proxy Statement

On April 17, 2023, the Board reviewed and approved by the Board on February 15, 2022.Finance Committee Charter. The Finance Committee met ten (10)five (5) times in 2021.2023. Messrs. Ebert, LeDonne and Becker and Ms. Spielman served on the Finance Committee for fiscal year 20212023 and during the period leading up to the Annual Meeting, with Mr. EbertLeDonne serving as the Chairman.Chairperson. The Board intends to appoint Mr.same committee membership will continue with Mr LeDonne continuing to serve as Chairman. Mr. Becker and Ms. Spielman will continue to serve on the Finance Committee following the Annual Meeting. Mr. Ebert will not serve on the Finance CommitteeChairperson following the Annual Meeting.

HRHuman Resources & Compensation Committee

The purpose of the Compensation Committee is to:

1.attend to all human resources issues that come before the Board;

2.review, recommend and evaluate CEO compensation;

3.conduct an annual CEO performance evaluation and goal setting process;

4.oversee senior management succession planning including the CEO;

5.approve senior management salaries; and

6.establish director compensation.

The Compensation Committee is also is responsible for the administration of all executive incentive plans. The Compensation Committee reports the results from these meetings to the Board.

None of the members of our Compensation Committee are, or have been, an officer or team member of MVB. During fiscal year 2021, no member of our Compensation Committee had any relationship with MVB requiring disclosure under Item 404 of Regulation S-K. None of our executive officers serve as a director or compensation committee member of a company that has an executive officer serving on our Compensation Committee or our Board.

The Committee has the authority, in its sole discretion, to obtain advice and assistance from, and to retain at MVB’s expense, such independent or outside legal counsel specializing in proxy disclosure, accounting, compensation or other advisors and experts as the Committee determines necessary or appropriate to carry out its duties.

Pay Governance, LLC (“Pay Governance”) has served as the Compensation Committee’s independent compensation advisor since the fall of 2021. The Compensation Committee has direct access to its compensation advisor and may engage its compensation advisor on an as needed basis for advice with respect to the amount and form of executive and director compensation.

The Compensation Committee Charter wasdetermined that the work performed by Pay Governance during the 2023 fiscal year did not raise any actual conflict of interest or compromise the independence of Pay Governance. Additionally, the Compensation Committee determined that Pay Governance qualified as independent for purposes of SEC Rule 10C-1(b)(4) and Section 805(c)(4) of the NYSE American Rules.

On April 17, 2023, the Board reviewed and approved by the Board on December 21, 2021.Compensation Committee Charter. The Compensation Committee met nine (9)seven (7) times in 2021.2023. Messrs. Becker and Ebert, and LeDonneMs. Slader served on the Compensation Committee for fiscal year 20212023 and during the period leading up to the Annual Meeting, with Mr. LeDonneBecker serving as the Chairman. Following the Annual Meeting, the Board intends to appointChairperson. The same committee membership will continue with Mr. Becker continuing to serve as Chairman, and Messrs. Alvarez and Ebert will serve as members of the Compensation Committee. Mr. LeDonne will not serve on the Compensation CommitteeChairperson following the Annual Meeting.

Compensation Committee Interlocks and Insider Participation

None of the Compensation Committee members are, or have been, officers or team members of MVB. During fiscal year 2023, no member of our Compensation Committee had any relationship with MVB requiring disclosure under Item 404 of Regulation S-K. None of our executive officers serve as a director or compensation committee member of a company that has an executive officer serving on our Compensation Committee or our Board.

Nominating and Corporate Governance Committee

The purpose of the N&CG Committee is to help assure that MVB fulfills the responsibilities for effective board governance of MVB and its subsidiaries by:

1.helping MVB to create and maintain an appropriate board and committee structure;

2.assessing the skills, experience, and backgrounds necessary to effectively staff MVB boards and committees;committees effectively;

3.overseeing the development and updating of governance for MVB;

4.overseeing the emergency succession plan for MVB;

5.leading MVB in periodic assessments of the operation of MVB boards and committees and the contributions of the members; and

6.monitoring the implementation of MVB governance policies and practices.

The N&CG Committee reports the results from these meetings to the Board. TheOn February 13, 2024, the Board reviewed and approved the N&CG Committee Charter was reviewed and approved by the Board on December 14, 2021.Charter. The N&CG Committee met six (6)seven (7) times in 2021.2023. Messrs. Ebert and Holt, andDr. Nelson, and Ms. SainsburyOwen served on the N&CG Committee, with Mr. Ebert serving as the ChairmanChairperson for fiscal year 20212023 and during the period leading up to the Annual Meeting. If elected, the Board intends to appoint Ms. Slader to replace Ms. Sainsbury to serve on the Committee as well as Messrs. Ebert, Holt, and Nelson,The same committee membership will continue with Mr. Ebert continuing to serve as ChairmanChairperson following the Annual Meeting.

Risk and Compliance Committee

The purpose of the Risk and Compliance Committee is to:

1.oversee MVB’s risk management program for effectiveness and ensure the Board incorporates the appropriate risk management processes in its work;

2.provide oversight for key banking regulations and compliance requirements, including MVB’s compliance with Bank Secrecy Act, Anti Money Laundering Program, and Office of Foreign Asset Control (“OFAC”) program;

3.ensure adherence to the Insider Borrowing Policy with all borrowings;

4.assist the Board in monitoring the Information Security Program and related activities;

5.oversee the fraud and identity risk management programs; and

6.review and evaluate the adequacy of the work performed by the various MVB compliance areas and ensure that they have adequate resources to fulfill their duties.

MVB Financial Corp. 2022 Proxy Statement

The Risk and Compliance Committee reports the results from these meetings to the Board. The Risk and Compliance Committee Charter was reviewed and approved by the Board on May 26, 2020.April 17, 2023. The Risk and Compliance Committee met nine (9)thirteen (13) times in 2021.2023. Dr. Nelson, Mr. NelsonLeDonne and Mses. SainsburyOwen, Slader, and Spielman served on the Risk and Compliance Committee, with Mr.Dr. Nelson serving as the ChairmanChairperson for fiscal year 20212023 and during the period leading up to the Annual Meeting. If elected,Following the Board intends to appoint Ms. Slader to replace Ms. Sainsbury toAnnual Meeting, Mr. LeDonne will no longer serve on the CommitteeCommittee; however, the rest of the committee membership will continue to serve, with Dr. Nelson remaining as well as Messrs. LeDonne andChairperson. In addition to committee participation, Dr. Nelson and Ms. Spielman maintain regular open dialogue with Mr. Nelson continuing to serve as Chairman following the Annual Meeting.Bank’s Chief Operations Officer and Chief Risk Officer and participate in routine touchpoints with the Bank’s regulators.

Board Leadership Structure

The Second Amended and Restated Bylaws (the “Bylaws”) of MVB currently provide for a Board of Directors composed of five (5) to twenty-five (25) members. As of December 31, 2021,2023, the Board consisted of nine (9) directors. In January 2022, the Board expanded the number of directors to ten (10) and appointed Daniel W. Holt as a director to fill the newly created vacancy.

Directors are elected by a plurality of the votes cast. Therefore, votes withheld and broker non-votes will not affect the outcome of the election of directors. As required by West Virginia law, each share is entitled to one vote per nominee, unless a shareholder properly notifies MVB of his or her intent to cumulate his or her votes for directors at least 48 hours before the meeting. If a shareholder properly notifies MVB of such intent to cumulate his or her votes, then each MVB shareholder will have the right to multiply the number of votes they are entitled to cast by the number of directors for whom they are entitled to vote and cast the product for a single candidate or distribute the product among two or more candidates. If any shares are voted cumulatively for the election of directors, the proxies, unless otherwise directed, shall have full discretion and authority to cumulate their votes and vote for less than all such nominees. For all other purposes, each share is entitled to one vote.

MVB Financial Corp. 2024 Proxy Statement

MVB’s Articles of Incorporation, as amended (the “Articles”), provide for staggered terms for directors. The three individuals up for election at the Annual Meeting represent the nominees to the Board for a three-year term to expire in 2025.2027. Following the election of the three nominees referenced below, MVB will have three classes of directors consisting of three Board members whose term expires in 2025,2027, three Board members whose term expires in 20242026 and three Board members whose term expires in 2023.2025.

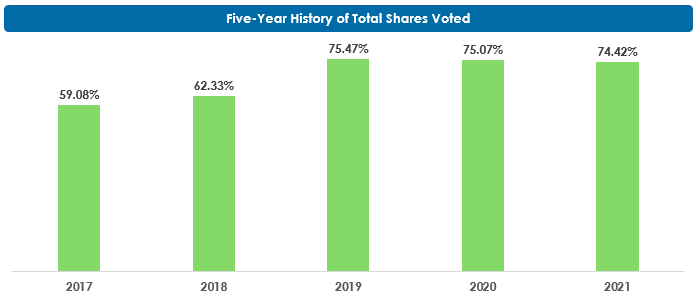

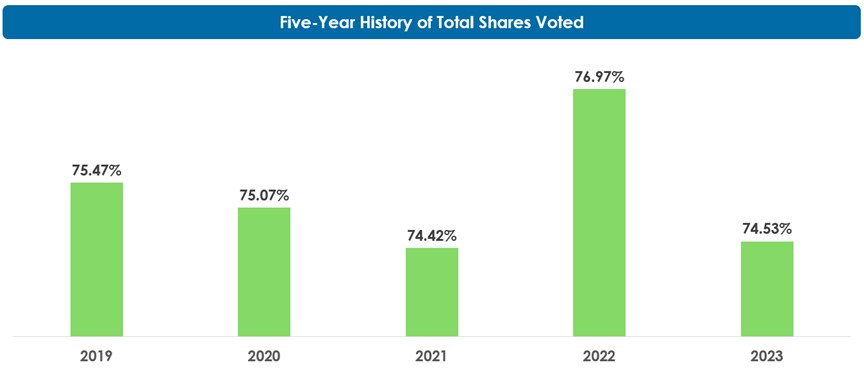

During each of the past threefive years, the N&CG Committee reviewed the concept of moving to a declassified Board of Directors. While the N&CG Committee, and ultimately the Board, recognized the value of and is supportive ofsupported having a declassified Board of Directors, such a change would require an amendment to the Articles. Furthermore, an amendment to the Articles for the purpose of declassifyingto declassify the Board requires the approval of the holders of at least 75% of the voting power of all the shares of MVB entitled to vote in the election of directors. Since MVB’s listing on the Nasdaq Capital Market in December 2017, the highest amountnumber of total votes cast by shareholders was 75.47%76.97% with the most recent three-year average of 74.99%75.30%.

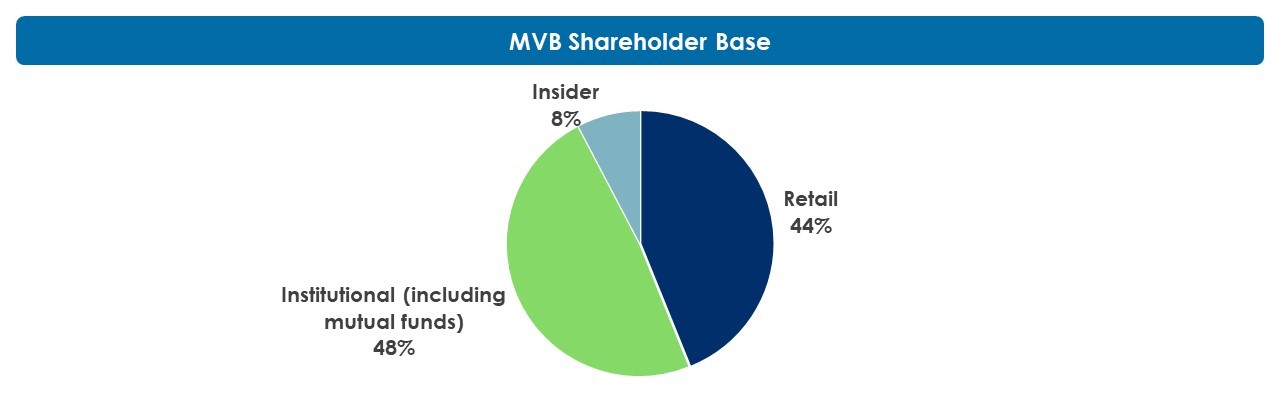

MVB's shareholder base is an even mix of retail and non-institutional investors.

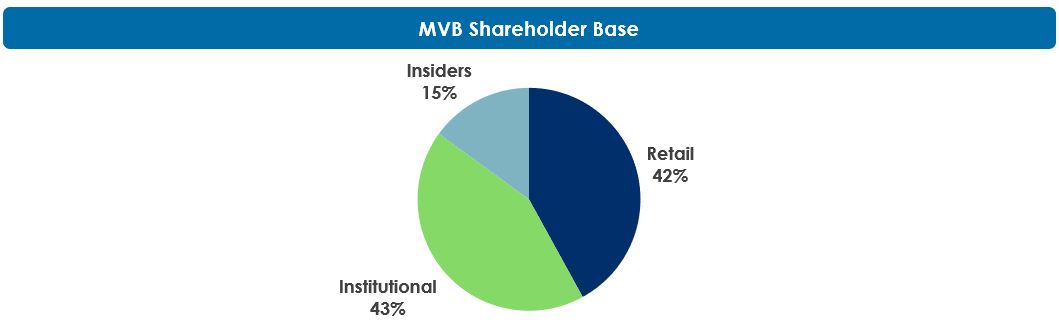

MVB's shareholder base is primarily made up of non-institutional investors.

The Board has therefore concluded that, based on historical shareholder participation, a proposal to declassify the Board would likely not receive the required shareholder approval at this time. The Board has determined that making a recommendation at this time to declassify the Board would not be in good faith to the shareholders, given the Board's belief that such recommendation would not be approved by the necessary number of shareholders.shareholders would not approve such a recommendation. The Board will continue to evaluate and monitor the appropriateness of presenting a proposal to declassify the Board in future years. We believe that as our shareholder base transitions from our legacy retail shareholders to more institutional and mutual funds the voting percentage is likely towill increase allowing us to bring declassification to a vote.

The Board Chair, CEO and President are three separate individuals. In previous years, the same individual occupied the CEO and President positions were occupied by the same individual;positions; however, in January 2022, the Board announced changes to the management organizational structure that included the bifurcation of these positions in order to support certain key initiatives within the organization. The CEO is responsible for theMVB’s day-to-day operations and performance of MVB. The President is responsible for corporate development. The Board Chair is involved in presiding over Board meetings, matters of governance, and corporate oversight. The Board Chair also focuses on monitoring the effectiveness of the CEO in implementing MVB’s corporate strategy and ensuring that the directors receive sufficient information, on a timely basis, to provide proper risk oversight. The Board believes the current separation of these roles helps to ensure good board governance and fosters independent oversight to protect the long-term interests of the Company's shareholders. In addition, the Board believes this separation is presently appropriate as it allows the President to focus on corporate development and delivering enhanced shareholder value and allows the CEO to focus primarily on leading the Company's day-to-day business and affairs while the Board Chair can focusconcentrate on leading the Board in its consideration of strategic issues and monitoring corporate governance and shareholder matters.

The entire Board is involved in overseeing risk associated with the Company’s operations. The committee structure of the Board is such that the Board committees are responsible for and review the areas of greatest risk to MVB. Each committee is chaired by anAn independent director.director chairs each committee. Members of management and other MVB staff members provide support to the respective Chairs of each committee in providing requested information necessary for each committee to provide appropriate risk oversight.

Annual Board and Committee AssessmentEvaluation

When analyzing whether directors and nominees have the qualifications, expertise, diversity and attributes to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the N&CG Committee seeks candidates who will add value to our Board by bringing varied skills, experience and perspective.

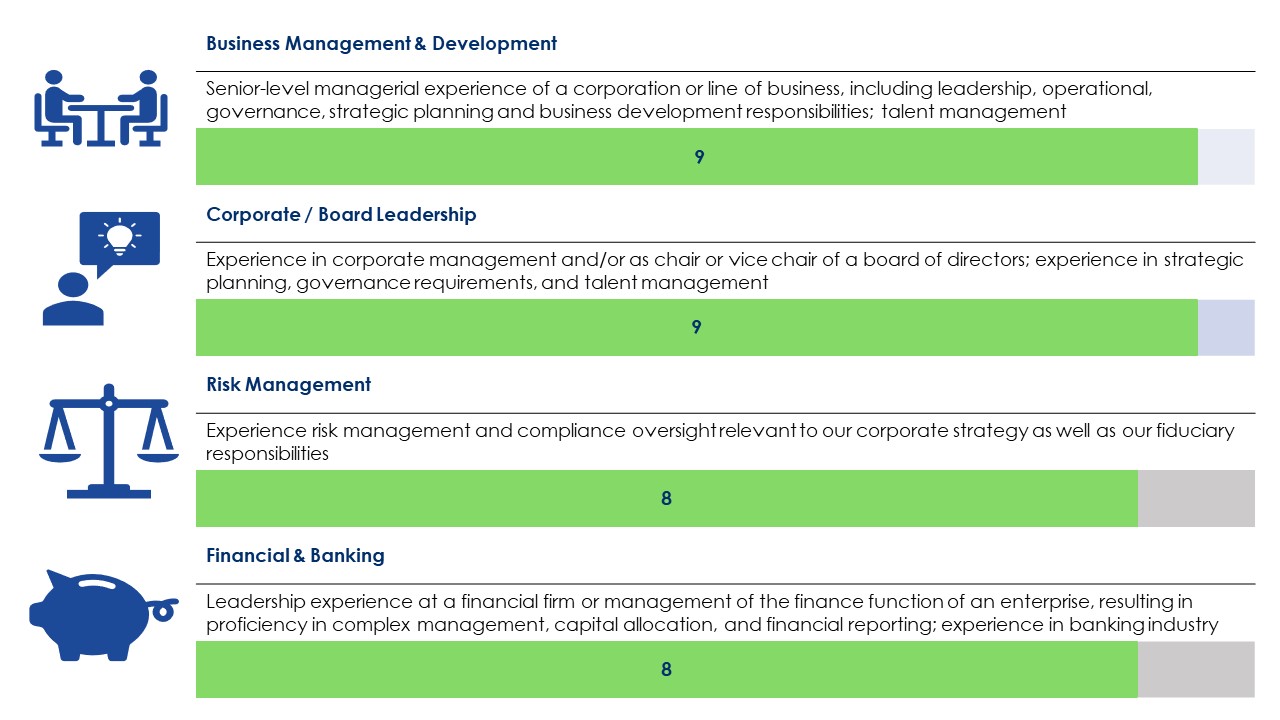

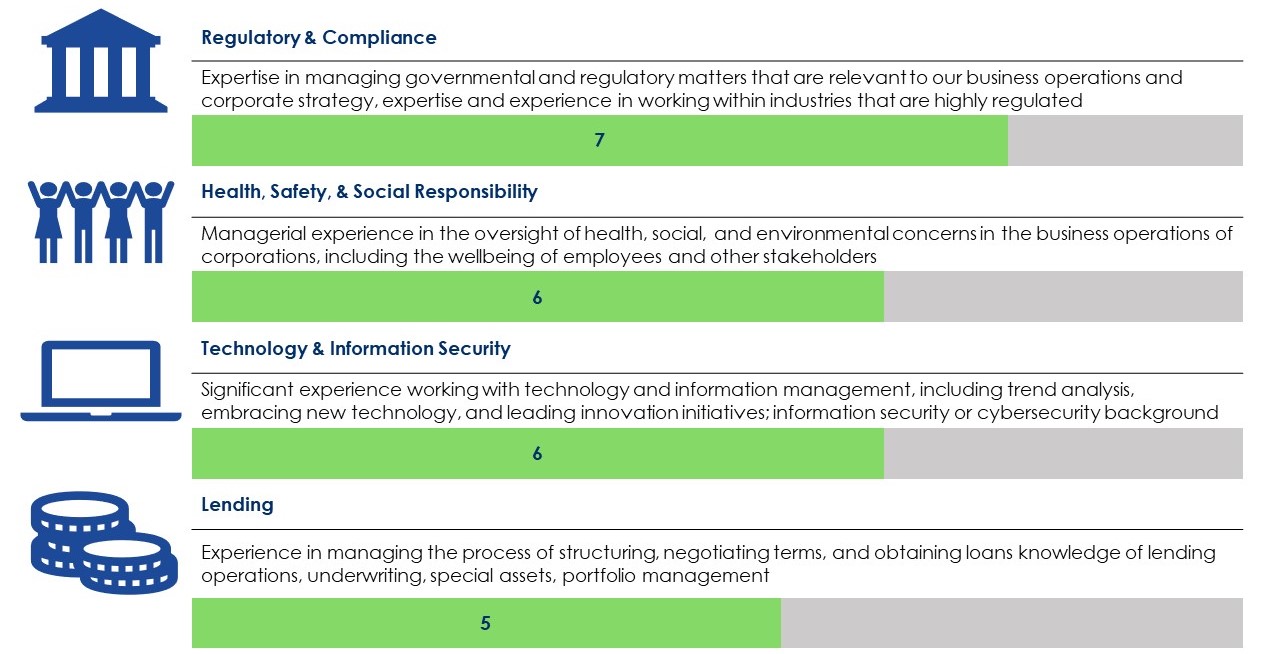

The Board conducts an annual Board assessment including Board member peer feedback. ThisThe Board uses this information is used to identify areas of strength or areas that may require additional focus going forward. MVB also maintains a skills profile matrix that reflects the combined background of the current membership of the Board and MVB’s subsidiary boards. This matrix is based on various focus areas of

MVB Financial Corp. 2022 Proxy Statement

experience and expertise determined to bethat are essential for appropriate strategic direction, advisory depth and oversight from all MVB boards of directors. The N&CG Committee works with the boards and leadership of MVB to determine the level of experience or application in each focus area according to limited, basic, skilled and expert experience. Our Board has a strong mix of thisthese criteria in areas most critical to MVB's success.

MVB Financial Corp. 2024 Proxy Statement

The number in each respective bar chart below represents the number of directors and director nominees of the Board with expert skills in the critical focus areas:

The information shown below in our Board Diversity Matrix is based on self-identification of each member of the Board (and each director nominee).

| | | | | | | | | | | | | | |

| Board Diversity Matrix |

| Total Number of Directors = 9 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 2 | 7 | 0 | 0 |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 1 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 2 | 6 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

| | | | | | | | | | | | | | |

| Board Diversity Matrix |

| Total Number of Directors = 9 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 3 | 6 | 0 | 0 |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 3 | 6 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

MVB Financial Corp. 20222024 Proxy Statement

As MVB grows and our strategy evolves, so do the skills, qualifications, attributes and experiences necessary for our directors. As such, we believe that periodically refreshing our Board with new perspectives and ideas is critical to representing the interests of our shareholders effectively. At the same time, it is equally important to benefit from the valuable experience and continuity that longer-serving directors bring to the Board. Our directors reflect a range of tenures, a balanced mix of ages, and a well-rounded range of attributes, viewpoints and experiences reflective of our business and needs. All members of the Board are successful business owners or organization leaders and have knowledge ofknow the requirements to run such a successful business.

The Board does not maintain a formal diversity policy with respect to the identification or selection of directors for nomination to the Board. Diversity is just one of many factors the N&CG Committee considers in the identificationidentifying and selection ofselecting director nominees. The Board defines diversity broadly to include differences in race, gender, ethnicity, age, viewpoint, professional experience, educational background, skills, and other personal attributes that can foster Board heterogeneity in order to encourage and maintain board effectiveness. While diversity and variety of experiences and viewpoints represented on the Board should always beare considered a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin or sexual orientation or identity. Inwhen selecting a director nominee, the N&CG Committee also focuses on a candidate’s skills, expertise orand background thatto ensure their appointment would complement the existing Board. The majority of our directors are or have been residents of our primary markets - North Central West Virginia or Northern Virginia; however, with the expansion of our client base and sales footprint, we have added directors throughout the country. Our directors come from diverse backgrounds including the financial, industrial, professional, information technology, and gaming industries.

Audit Committee Financial Experts

The Board has designated Gary A. LeDonne and Cheryl D. Spielman as individuals who are considered to be audit committee financial experts. They have both been identified as meeting the guidelines set forth by Section 407 of the Sarbanes-Oxley Act of 2002 for an audit committee financial expert. The audit committee financial experts, along with all Audit Committee members, are independent as defined by applicable listing standards and guidelines.

Code of Ethics

The Board has established a Code of Ethics for Senior Financial Officers that applies to our senior executive and financial officers, including our principal executive officer, principal financial officer, principal accounting officer, and persons performing similar functions. We also maintain a Code of Conduct that governs all of our directors, officers and team members. A copy of the Code of Ethics for Senior Financial Officers and the Code of Conduct are available at ir.mvbbanking.com/govdocs. We will promptly disclose any future amendments to these codes on our website, as well asand any waivers from these codes for executive officers and directors. Copies of these codes will also be available in print from our Corporate Secretary, without charge, upon request.

Transactions with Related Persons

MVB and MVB Bank have, and expect to continue to have, banking and other transactions in the ordinary course of business with their directors and officers and their affiliates, including members of their families or corporations, partnerships or other organizations in which officers or directors have a controlling interest, all on substantially the same terms (including documentation, price, interest rates, and collateral, repayment and amortization schedules and default provisions) as those prevailing at the time for comparable transactions with unrelated parties. All of these transactions were made on substantially the same terms (including interest rates, collateral and repayment terms on loans) as comparable transactions with non-affiliated persons. MVB’s management believes that these transactions did not involve more than the normal business risk of collection or include any unfavorable features. All related-party loans require approval from the Board.

Since 2017, MVB Bank has maintained a commercial lending relationship with BillGO, Inc. (“BillGO”), a company in which Mr. Holt, a director, nominee, is Co-Founder and CEO. OnIn January 17, 2022, the MVB Bank board of directors approved a $35 million line of credit with BillGO secured by a deposit account maintained by BillGO with MVB Bank. The line of credit with BillGO was entered into in the ordinary course of business and on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with unrelated parties. MVB’s management believes that this banking relationship does not involve more thanAs of December 31, 2023, the normal business riskline of collection or include any unfavorable features.credit to BillGO as been closed. Since 2016, MVB and MVB Bank have made periodic debt and equity investments in BillGO. During the year ended December 31, 2021,Additionally, MVB and MVB Bank collectively purchased $2.5 million in convertible debtrecognized $227,000 of BillGO, increasing their aggregate total investment in BillGO to approximately $10.1 million.

During the year ended December 31, 2021, ProCo Global, Inc. (“Chartwell,” which does business under the registered trade name Chartwell Compliance), a subsidiary of MVB Bank, provided compliance and consulting services to BillGO pursuant to a Consulting Agreement (“Consulting Agreement”) between Chartwell and BillGO entered into in April 2017. In exchange for the services provide to pursuant to the Consulting Agreement, BillGO paid Chartwell $425,405service fee revenue during the year ended December 31, 2021.2023 from BillGo.

With the exception of MVB and MVB Bank’s relationships with Mr. Holt and BillGO, since January 1, 2020, MVB and MVB Bank have not been a party to any transaction or series of similar transactions in which the amount involved exceeded or will exceed $120,000 and in which any then director, executive officer, holder of more than 5% of MVB’s common stock, or any member of the immediate family of any of the foregoing, had or will have a direct or indirect material interest, other than in connection with the transactions described.

MVB has not identified any arrangements or agreements relating to compensation provided by a third party to MVB’s directors or director nominees in connection with their candidacy or Board service as required to be disclosed pursuant to Nasdaq rules.

Policies and Procedures for Related Party Transactions

Our Board has adopted a written corporate conduct policy that includes procedures for identifying, reviewing, and approving related party transactions to ensure compliance with SEC regulations, Nasdaq requirements, and other applicable rules and regulations. Further, our Board has adopted a written loan policy requiring that any related party loans be reviewed and approved or disapproved by our Board or a duly authorized committee. In reviewing such loans, the Board or a duly authorized committee considers, among other factors it deems appropriate, whether the interested transaction is on terms substantially similar to terms offered to comparably situated customers who are not related parties.

Attendance of Directors at Annual Meeting of Shareholders

MVB expects all of its directors to attend the Annual Meeting. All directors serving at the time of the 20212023 annual meeting of shareholders attended the meeting.

Communications with the Board

Any shareholder desiring to contact the Board or any individual director serving on the Board may do so by written communication mailed to: Board of Directors (Attention: (name of director(s), as applicable)), care of the Corporate Secretary, MVB Financial Corp., 301 Virginia Avenue, Fairmont, WV 26554. Any proper communication so received will be processed by the Corporate Secretary as agent for the Board. Unless, in the judgment of the Corporate Secretary, the matter is not intended or appropriate for the Board (and subject to any applicable regulatory requirements), the Corporate Secretary will prepare a summary of the communication for prompt delivery to each member of the Board or, as appropriate, to the member(s) of the Board named in the communication. Any director may request the Corporate Secretary to produce for his or her review the original of the shareholder communication.

communication for his or her review.

MVB Financial Corp. 20222024 Proxy Statement

Directors

This section describes the experience and qualifications of our Board members and how they are compensated.provides details about their compensation.

DirectorsDirector Overview

When analyzing whether directors and nominees have the qualifications, expertise, diversity and attributes to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the N&CG Committee seeks candidates who will add value to our Board of Directors by bringing varied skills, experience, and perspective.

The Board conducts an annual board assessment including Board member peer feedback. This information is used to identify areas of strength or areas that may require additional focus going forward. MVB also maintains a skills profile matrix that reflects the combined background of the current membership of the Board and MVB’s subsidiary boards or directors. This matrix is based on various focus areas of experience and expertise determined to bethat are essential for appropriate strategic direction, advisory depth and oversight from all MVB boards of directors. The N&CG Committee works with the boards and leadership of MVB to determine the level of experience or application in each focus area according to limited, basic, skilled and expert experience. Our Board has a strong mix of thisthese criteria in areas most critical to MVB's success.

As MVB grows and our strategy evolves, so do the skills, qualifications, attributes and experiences necessary for our directors. As such, we believe that periodically refreshing our Board with new perspectives and ideas is critical to representing the interests of our shareholders effectively. At the same time, it is equally important to benefit from the valuable experience and continuity that longer-serving directors bring to the Board. Our directors reflect a range of tenures, a balanced mix of ages, and a well-rounded range of attributes, viewpoints and experiences reflective of our business and needs.

Diversity is just one of many factors the N&CG Committee considers in the identification and selection of director nominees. The Board defines diversity broadly to include differences in race, gender, ethnicity, age, viewpoint, professional experience, educational background, skills, and other personal attributes that can foster Board heterogeneity in order to encourage and maintain board effectiveness. While diversity and variety of experiences and viewpoints represented on the Board should always beare considered a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin or sexual orientation or identity. Inwhen selecting a director nominee, the N&CG Committee also focuses on a candidate’s skills, expertise orand background thatto ensure their appointment would complement the existing Board. The majority of our directors are or have been residents of our primary markets - North Central West Virginia or Northern Virginia; however, with the expansion of our client base and sales footprint, we have added directors throughout the country. Our directors come from diverse backgrounds including the financial, industrial, professional, and information technology.

For reference, the Board believes that candidates for director should have certain minimum qualifications, including:

•Directors should be of the highest ethical character.

•Directors should have excellent personal and professional reputations.

•Directors should be accomplished in their professions or careers.

•Directors should be able to read and understand financial statements and either have knowledge of, or the ability and willingness to learn, financial institution law.

•Directors should have relevant experience and expertise to evaluate financial data and provide direction and advice to the chief executive officer and the ability to exercise sound business judgment.

•Directors must be willing and able to expendspend the time to attend meetings of the Board and to serve on Board committees.

•The Board will consider whether a nominee is independent, as defined under applicable SEC and Nasdaq standards. In addition, directors should avoid the appearance of any conflict and should be independent of any particular constituency and be able to serve all shareholders of MVB.

•Directors must be acceptable to MVB's and MVB Bank's regulatory agencies, including the Federal Reserve Board, the Federal Deposit Insurance Corporation and the West Virginia Division of Financial Institutions and must not be under any legal restriction which prevents them from serving on the Board or participating in the affairs of a financial institution.

•Directors must own or acquire sufficient capital stock to satisfy the requirements of West Virginia law, the Bylaws and the share ownership guidelines as established by MVB.

•Directors must be at least 21 years of age.

The Board reserves the right to modify these minimum qualifications from time to time, except where the qualifications are required by the laws relating to financial institutions.

Our Board recognizes the importance of consistent, deliberate Board refreshment and succession planning to ensure that the directors possess a composite set of skills, experience and qualifications necessary for the Board to successfully establish and oversee management’s execution of the Company’s strategic priorities.

In addition, the N&CG Committee identifies and evaluates nominees as follows: In the case of incumbent directors whose terms are set to expire, the N&CG Committee considers the directors’ overall service to MVB or MVB Bank during their term, including such factors as the number of meetings attended, the level of participation, quality of performance and any transactions between such directors and MVB and MVB Bank. The N&CG Committee also reviews the payment history of loans, if any, made to such directors by MVB Bank to ensure that the directors are not chronically delinquent and in default.

The N&CG Committee considers whether any transactions between the directors and MVB Bank have been criticized by any banking regulatory agency or MVB Bank’s external auditors and whether corrective action, if required, has been taken and was sufficient. The N&CG Committee also confirms that such directors remain eligible to serve on the board of directors of a financial institution under federal and state law.

The Board will consider director candidates recommended by shareholders for nomination, provided that the recommendations are received at least 90 days prior to the anniversary of the previous year's annual meeting of shareholders. In addition, shareholders must follow the procedures set forth below must be followed by shareholders for submitting nominations for directors to the shareholders.directors. The Board does not intend to alter the manner in which it evaluates candidates, regardless of whether or not the candidate was recommended or nominated by a shareholder.

For new director candidates, the N&CG Committee uses its network of contacts to compile a list of potential candidates. The N&CG Committee then meets to discuss each candidate and whether he or she meets the criteria set forth above. The N&CG Committee then discusses each candidate’s qualifications and chooses a candidate by majority vote.

In January, 2022,Director Orientation and Continuing Education

We designed our orientation programs to familiarize new directors with our businesses, strategies, and policies and assist new directors in developing Company and industry knowledge to optimize their service on the N&CG Committee identified Lindsay A. Slader as a candidate with significantBoard. Regular continuing education programs enhance the skills and knowledge and experience in the lines of business development, gaming, technology, fraud prevention and regulatory compliance and recommended herdirectors use to the Board for consideration. The Board voted unanimously to nominate her for election at the 2022 Annual Meeting of Shareholders. If elected, Ms. Slader will be appointed to MVB’s Risk and Compliance Committee as well as the N&CG Committee.perform their responsibilities. These programs may include internally developed programs or programs presented by third parties.

MVB Financial Corp. 20222024 Proxy Statement

Shareholder Nominations of Directors

The Bylaws provide that nominations for election to the Board must be made by a shareholder in writing and delivered or mailed to the President of MVB not less than 90 days prior to the anniversary of the previous year's annual meeting of shareholders, provided, however, that if the date of the annual meeting is more than 30 days before or more than 70 days after the anniversary of the previous year's annual meeting, the nominations must be mailed or delivered to the President not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. In no event shall any adjournment or postponement of a meeting or the announcement thereof commence a new time period or extend any time period for the giving of a shareholder’s notice.

The notice of nomination must contain the following information, to the extent known:

•Name, address and addressdate of birth of the proposed nominee(s);

•Principal occupation of the nominee(s);

•Total shares to be voted for each nominee;

•Name and address of the nominating shareholder; and

•Number of shares owned by the nominating shareholder.

Nominations not made in accordance with these requirements may be disregarded by the Board and in such case the votes cast for each such nominee will likewise be disregarded. All nominees for election at the Annual Meeting with the exception of Lindsay A. Slader, are incumbent directors or directors of MVB subsidiaries and are included as nominees in this Proxy Statement upon the recommendation of the N&CG Committee. No shareholder recommendations or nominations have been made for the election of directors at the 20222024 Annual Meeting.

Nominations for election to the Board for the 20232025 Annual Meeting of Shareholders must be made by a shareholder in writing and delivered or mailed to the President of MVB on or before Thursday, February 16, 2023.20, 2025.

Nominees for Election

For this year’s election, the Board has nominated three director candidates.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Year First Elected | | Position |

| John W. Ebert | | 64 | | 2005 | | Director |

| Kelly R. Nelson, MD | | 64 | | 2004 | | Director |

| Jan. L. Owen | | 72 | | 2022 | | Director |

The following biographical information about each director nominee highlights the particular experience, qualifications, attributes, and skills possessed by such director nominee that led the Board to determine that he or she could serve as a director. All director nominee biographical information is as of March 28, 2022:27, 2024:

| | | | | | | | |

| DanielJohn W. Holt(3-year term)Ebert

MVB Director Nominee (3-year term) |

John W. Ebert, 64, is President of J.W. Ebert Corporation, which owns 40 McDonald’s franchises in West Virginia, Pennsylvania and Maryland. Mr. Holt, 50, is Co-Founder & CEO of BillGO, an award-winning real-time bill management and payments platform that servesEbert has more than 30 million consumers and thousandsyears of financial institutions, fintech companies, and billers. Under his leadership, BillGO has becomeretail experience.

Mr. Ebert is currently the top bill payments engine inVice Chair of the financial industry. After serving eight years in the U.S. Air Force, Mr. Holt held several leadership positions in Silicon Valley. For eight years, his team at HEIT built the leading cloud services company for the financial industry. Upon its acquisition, Mr. Holt led CSI’s technology and services as President and General Manager. During his tenure, CSI became the largest secure banking cloud for community banks and credit unions. |

Mr. Holt has served on boards for Allied Payment Network, Dragnet Solutions and Community Funded, and he mentors students in Colorado State University’s Entrepreneurship Program. He earned certifications as a Project Management Professional, Certified Information Systems Security Professional and GIAC Systems and Network Auditor.McDonald’s Columbus Field Office operator organization representing over 1,200 restaurants. He is also partthe former Chairman of McDonald’s East Division Profit Team representing 5,000 restaurants. He is the former President of the Fed Secure Payments Task Force.Pittsburgh Region’s McDonald’s Owner/Operator Association. Mr. Holt holdsEbert is a bachelor’s degree from1982 graduate of the University of Maryland and an MBA from Colorado State University.

Notre Dame with a Bachelor of Science degree in Accounting. He also attended entrepreneurial classes at MIT. He began his career as a Certified Public |

Accountant with Arthur Young & Co in Dallas, Texas. Mr. Holt currentlyEbert also serves on the GameChanger Board of Directors. GameChanger is a student-powered substance misuse prevention organization.

Mr. Ebert is currently Chair of MVB's N&CG Committee.Committee and serves on the Audit, Finance and Compensation committees. He is also serves as a director on MVB’s subsidiarymember of the board of directors of MVB Edge Ventures,Bank, Inc. Board. HeMr. Ebert is being nominated as a director due to his leadership, education,knowledge of the North Central West Virginia market, his educational background and his business proficiencies, which include the areas of budget, risk assessment, and professional development accomplishments in the financial and technology industries. With MVB’s continued expansion and focus on the fintech industry, his expertise is critical for Board enhancement.human resources. |

| | | | | | | | |

| Gary A. LeDonne (3-year term)Kelly R. Nelson, MD

MVB Director Nominee (3-year term) |

Mr. LeDonne, 60, serves as ExecutiveDr. Kelly R. Nelson, 64, is a Physician in Residence at the John Chambers College of Business & Economics ofBridgeport, West Virginia, University.and is affiliated with numerous hospitals in the region, including United Hospital Center and West Virginia University Medicine. He was formerly Senior Vice President of MedExpress Urgent Care, and for the prior 27 years, the Medical Director for Medbrook Medical Associates. He is extremely active in community organizations and is currently President and Board member of the Medbrook Children’s Charity. He is a retired Partnergraduate of Ernst & Young LLP, retiring in 2014 as East Central Region Tax Managing Partner. Throughout his careerAuburn University with Ernst & Young LLP, Mr. LeDonne served many banking, insurance, and capital market clients. He has an extensive background in strategy development, succession planning, and talent management. He received hisa Bachelor of Science degree from Fairmont Statein Biology and the University and his Master of Professional Accountancy degree from West Virginia University.Alabama, School of Medicine, specializing in Family Medicine. |

Mr. LeDonneDr. Nelson is a Certified Public Accountantcurrently Chair of MVB’s Risk and Compliance Committee and serves on the N&CG Committee. He also serves as a member of the American Institute of Certified Public Accountants and the American Accounting Association. Mr. LeDonne currently serves as Past Chair of the Fairmont State University Foundation board of directors and is a member of the Visiting Committee of the John Chambers College of Business & Economics of West Virginia University. Mr. LeDonne serves on the Advisory Board of Graphcoa - The Graphite Company of the Americas.

Mr. LeDonne currently serves as Chair of MVB's Compensation Committee, as well as Chair of the MVB Community Development Corporation, MVB Community Development Partners,Bank, Inc. and the Potomac Mortgage Group, Inc. board of directors. He is also a member of MVB's ALCO, Audit, Finance, and Loan Review committees and serves as a director of the Trabian Technology, Inc. board of directors. He is designated as an Audit Committee Financial Expert by the Board. Mr. LeDonneDr. Nelson is being nominated as a director because offor his extensive knowledgeunderstanding of the Mid-Atlantic regionmedical community in North Central West Virginia, his educational and business communityinsight, and his investment, financial, and accounting expertise.community activities throughout the region. |

MVB Financial Corp. 20222024 Proxy Statement

| | | | | | | | |

| Lindsay A. Slader (3-year term)Jan L. Owen

MVB Director Nominee (3-year term) |

Ms. Slader, 36, serves as the Managing Director of Gaming at GeoComply, a cybersecurity and fraud prevention firm delivering geolocation and user authentication technologies to the gaming, media & entertainment, online banking, payments and cryptocurrency industries. She joined the company in its infancy in 2012 as its first employee, and currently leads GeoComply’s core business in online gaming and sports betting, including the gaming business’ product, marketing, revenue, regulatory compliance, and operational verticals. |

Having worked in the internet gaming and digital services industries for fifteen years, Ms. Slader is a recognized expert in her field; regularly speaking at industry conferences, and as a weekly media contributor to both mainstream business and gaming industry publications. Over the last decade, Ms. Slader has provided expert witness testimony on regulatory compliance, geolocation technologies, and her gaming industry expertise at several state and federal hearings. Prior to GeoComply, she spent five years specializing in regulatory compliance, gaming technology, and business development at gaming compliance testing companies Gaming Laboratories International and Technical Systems Testing.

Ms. Slader’s contributions to the iGaming industry have been significant leading her to win awards such as 2019 Emerging Leaders of Gaming 40 Under 40 and the 2021 iGaming Business Most Influential Women.

Ms. SladerJan L. Owen, 72, is a graduate of California State University, Fresno, where she earned her Bachelor of Arts degree in Economics. Ms. Owen retired in 2023 as a senior advisor in the UniversityFinancial Services Group at Manatt, Phelps & Phillips, LLP, based in the Sacramento, California, office. Her practice included a wide range of British Columbia, with BA in political scienceoversight work, including accountancy, assets recovery, auditing, banking, benefits administration, corporate governance counseling, strategic planning, public policy review and international relations. She also holds a Post-Graduate Diploma in Urban Studies from Simon Fraser University,analysis, regulatory representation, budget preparation and certificate in European Strategic Policy from Science Po Lille.

financial reporting. Her clients included major banks and consumer financial institutions, Fintech startups, blockchain and cryptocurrency companies, cannabis owners and operators and technology companies. |

If elected by the shareholders at the annual meeting,From 2013 to 2019, Ms. Slader will be appointed to serve on MVB’s Risk and Compliance Committee, as wellOwen served as the N&CG Committee.Commissioner of California’s Department of Business Oversight, which is now known as the Department of Financial Protection and Innovation, the state of California’s financial regulator. Prior to that, from 2011 to 2013, she served as Commissioner of the California Department of Corporations. Before serving in these significant public roles, Ms. Owen worked at a leading investment banking firm, one of the world’s leading consumer products companies and at her own consulting firm. She is a frequent speaker and author on topics relating to regulatory and consumer protection developments for California and other states nationwide.

Ms. Owen served as a member of the Board of Directors for the Bank of Southern California from 2020 to 2022. Since 2020, she has been a member of Kraken Bank’s Board of Directors and, since 2019, she has served on the Advisory Boards of Radicle Impact and Jiko.

Ms. Owen serves as a member of both the Risk & Compliance and Nominating & Corporate Governance Committees of the Board. Ms. Owen also serves as a member of the board of directors of MVB Bank, Inc. Ms. Owen is being nominated because ofas a director due to her significant knowledge and experience in the lines of business development, gaming, technology, fraud preventionfederal, state and international regulatory compliance.requirements and her strong background in payments and cryptocurrency.

|

Directors Not Up For Election

The following table sets forth certain information as of March 27, 2023 with respect to directors who are not up for election:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Year First Elected | | Position |

| W. Marston Becker | | 71 | | 2020 | | Director |

| Daniel W. Holt | | 52 | | 2017 | | Director |

| Gary A. LeDonne | | 62 | | 2016 | | Director |

| Larry F. Mazza | | 63 | | 2005 | | Chief Executive Officer and Director |

| Lindsay A. Slader | | 38 | | 2022 | | Director |

| Cheryl D. Spielman | | 69 | | 2019 | | Director |

The following biographical information about each director nominee highlights the particular experience, qualifications, attributes and skills possessed by such director nominee that led the Board to determine that he or she could serve as a director. All director nominee biographical information is as of March 28, 2022:27, 2024:

| | | | | | | | |

| David B. AlvarezW. Marston Becker

MVB Chair and Director |

Mr. Alvarez, 58, a native West Virginian, is a recognized owner, business leader and established serial entrepreneur, who remains very active in development, industry and community work. He is invested in multiple service related companies, which have grown to be respected regional service providers for the natural gas industry.

He has been involved in the construction business throughout the North Eastern United States for more than 30 years. He has started and grown a number of successful companies that continue to benefit West Virginia, Southwestern Pennsylvania and Northern Virginia.

|

As the principle of Hispanic family founded businesses, Mr. Alvarez, was instrumental in successfully growing Applied Construction Solutions, Inc. and Energy Transportation, LLC into well-respected, minority owned companies with a regional presence. Companies he has founded include Applied Construction Solutions, Inc., Energy Transportation, LLC and Blue Mountain Equipment Corporation. He is a graduate of West Virginia University with a Bachelor of Science degree in Business Administration. He is actively engaged in various professional, educational, and philanthropic activities throughout West Virginia and the region, including serving as immediate past chairman of the West Virginia University Board of Governors. He is a member of the Richmond Federal Reserve Industry Round Table for WV, the Medbrook Children’s Charity Board, WV Game Changers, and past member of the Harrison County Economic Development Corporation.

In 2008, Mr. Alvarez was honored by the U.S. Department of Justice Federal Bureau of Investigation as a recipient of the Director’s Community Leadership Award in recognition of his outstanding service to the local community and of enduring contributions to the advancement of justice. He also received an Achievement Award by the Small Business Administration in recognition of his entrepreneurial spirit and the successful completion of the SBA’s 8(a) Business Development Program and was named Business Leader of the Year by the WV News State Journal in January 2021.

Mr. Alvarez is Chairman of the Board of Directors of MVB Financial Corp, MVB Bank, Inc., and MVB Insurance and serves as a director of the MVB Community Development Corporation and the Potomac Mortgage Group, Inc., as well as the Loan Approval Committee of MVB Bank. We believe Mr. Alvarez’s knowledge of MVB’s base markets, the construction and natural gas industries, and his community in involvement make him qualified to serve as a member of the Board.

|

| | |

MVB Financial Corp. 2022 Proxy Statement

| | | | | | | | |

| W. Marston Becker MVB Director

|

Mr.“Marty” Becker, 69,71, is a seasoned executive with 35 years of experience including CEO and chairman leadership positions in insurance, reinsurance and insurance brokerage organizations in the U.S. and internationally, as well as insurance-related private equity, advisory and investment banking roles. Mr. Becker is the immediate past Chairman of the Board of QBE Insurance Group, a top 15 global property and casualty insurer. He was appointed to the Board of QBE Insurance Group in 2013, became Chair in 2014 and served until March 2020. |

Mr. Becker served as President and CEO of Alterra Capital Holdings Limited (“Alterra”) and its predecessors from 2006 to 2013. Mr. Becker serves on a variety of corporate boards in the financial services, manufacturing and non-profit sectors: directorDirectors of Axis Capital (NYSE: AXS), directorDirector of Encova Mutual Insurance in Columbus, Ohio; directorDirector of Amynta Group in New York City; Advisory Board member of private equity funds American Securities, Cohesive Capital and Madison Dearborn Partners; directorDirector of The Mountain Companies of Parkersburg, West Virginia; member of the Board of Governors of West Virginia University; directorDirector of the West Virginia Chamber of Commerce; and board memberBoard Member of the Clay Center for the Arts and Sciences.

Mr. Becker currently serves onis Chairman of the Board of Directors of MVB Financial Corp. and MVB Bank, Inc. He is also Chairman of MVB’s Compensation Committee as well asand serves on the Finance Committee. He is also a member of the MVB Edge Ventures board of directors. We believe Mr. Becker’s background in finance and mergers and acquisitions as well asand his experience serving on the board of a public company make him qualified to serve as a member of the Board. |

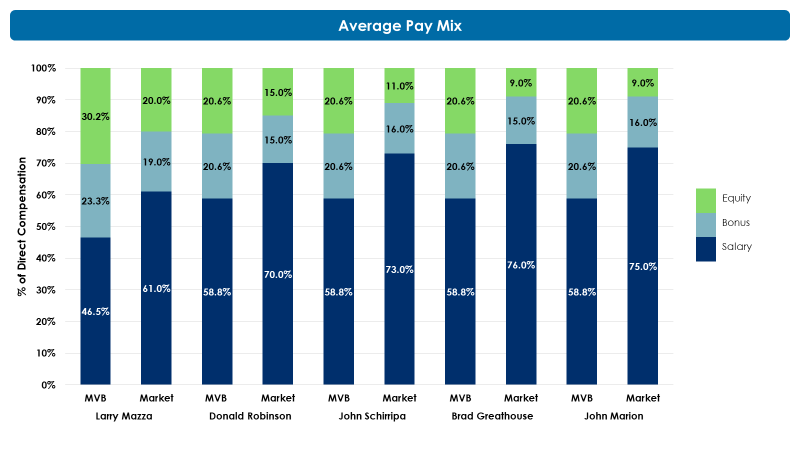

MVB Financial Corp. 2024 Proxy Statement